Financial Planning

Does Financial Planning

make a difference?

People that receive financial planning advice tend to end up wealthier than those who don’t. Several studies have found that individuals who take regular financial advice during their lifetime

end up substantially better off than those who don’t.*

Products are just tools to help you reach your goals and objectives and to help facilitate the

lifestyle you want. It’s important to firstly take time to clearly define these – really think what you want from life. Are there any big goals or dreams you would like to achieve?

Initial Meeting

Our aim is to help you build a clear picture of where you are financially and also help you plan where you want to be through an expert, professional and friendly service. An initial consultation of one hour will be at our cost and, during this, we will listen to your needs prior to agreeing the best way forward for you.

Financial Planning is a very personal matter. No two people have the same circumstances, ambitions or needs. We also recognise that people’s needs change over time, so the financial plan we create with you is unique to you and tailored to suit your individual needs, as well as being reviewed on a regular basis if you have signed up to one of our ongoing service options.

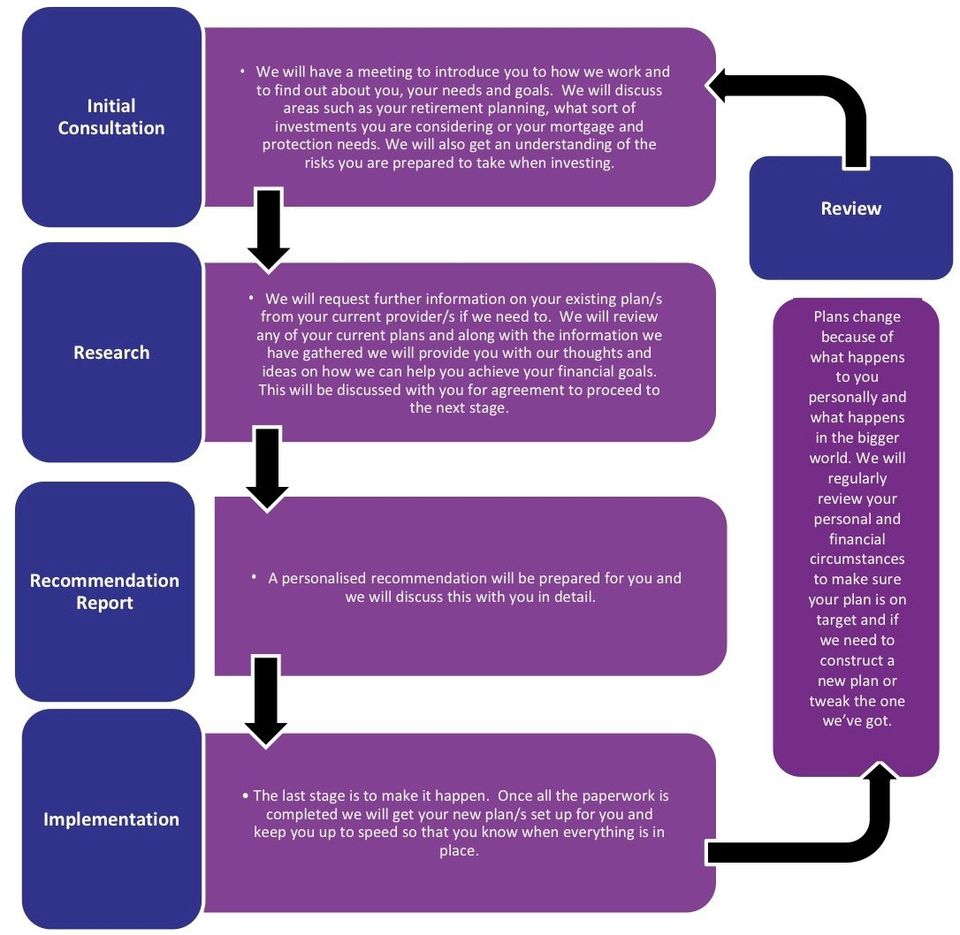

So how is your financial plan specifically developed for you? The planning process below is followed, ensuring you know exactly what is happening at each stage.

The Process

Initial consultation to identify your needs and objectives and gather information.

We will have a meeting to introduce you to how we work and to find out about you, your needs and goals. We will discuss areas such as your retirement planning, what sort of investments you are considering or your mortgage and protection needs. We will also get an understanding of the risks you are prepared to take when investing.

Research

We will request further information on your existing plan/s from your current provider/s if we need to. We will review any of your current plans and along with the information we have gathered, we will provide you with our thoughts and ideas on how we can help you achieve your financial goals. This will be discussed with you for agreement to proceed to the next stage.

Recommendation Report

A personal recommendation will be prepared for you and we will discuss this with you in detail.

Implementation

The last stage is to make it happen. Once all the paperwork is completed, we will get your new plan/s set up for you and keep you up to speed so that you know when everything is in place.

Review

Plans change because of what happens to you personally and what happens in the bigger world. We will regularly review your personal and financial circumstances to make sure your plan is on target. If your plans have changed, we can construct a new plan or tweak the one in place, if you have signed up to one of our ongoing service options.

If you haven’t signed up to one of our ongoing service options, then we will not review your personal and financial circumstances to make sure your plan is on target. You can still contact us though if you need new financial advice.

Cost

Our fees are competitive and will always be agreed with you in advance so you know exactly what you are paying for and how the fee will be paid. Fees are generally based on a percentage of the amount being advised upon. However, in some cases, a commission will be payable by the product provider or we may agree a fixed monetary amount for certain types of work or projects.

You can see our fees in our Client Agreement/Terms of Business which we can send you on request. Alternatively, please feel free to contact us to ask for more information.

What we do

We follow a clear process which is shown here.

* Source:

Morningstar 2013 Study

The study found that financial planning advice can add almost a third to the value of retirement wealth.

Old Mutual Redefining Retirement Survey

The survey found the average retirement income for those that took regular financial advice and who had a clear investment target was more than 50% higher that the average income for those who did not take regular advice.